As a doctor, honing your medical skills, building a reputation as a trusted healthcare provider, and most importantly, extending top-notch care to your patients are your top priorities.

However, if you feel as if the traditional, insurance-based model has not helped you tend to these priorities, concierge medicine might be the one for you.

Making the transition to concierge medicine is not a journey without its challenges. When it comes to creating a financial roadmap for concierge physicians, there is much ground to cover.

Concierge medicine is a valuable opportunity to provide personalized care to patients while generating a steady revenue stream.

This important endeavor entails careful financial planning to minimize debilitating financial mistakes and ensure long-term success.

As of 2024, the initial investment required to establish a concierge medicine practice can vary widely, typically ranging from $100,000 to $500,000.

Initial investment costs are influenced by several key factors, such as location, practice size, and service offerings.

Here at FindMyDirectDoctor.com, we have created this guide to help you navigate the growing pains of setting up your own concierge medicine practice and allow you to make guided decisions throughout the process.

If you're a doctor looking to make the switch to concierge medicine, there are three primary pathways to consider.

Each pathway has its unique advantages and challenges, and understanding these factors can help you make an informed decision about which route to take.

If you're currently employed by a hospital or medical company and want to start a concierge medicine business model from the ground up, there are several key factors to consider.

These include: office rent and overhead costs; labor expenses for hiring staff; marketing budget to promote your practice; and a timeline for securing funds to cover initial expenses.

Knowing the estimated costs of operating your clinic can also help you determine how much you can borrow from a bank. Typically, banks will loan 70-75% of the total cost, which can be repaid in installments until you break even or start earning a profit.

If you already have a traditional private practice and want to convert it to a concierge medicine business model, the initial investment will be lower since you already have the foundation of a private practice in place.

You also have an existing patient base, which can make the transition smoother.

To convert your practice, you'll need to:

Billing changes (insurance-based billing will be replaced with monthly subscription)

Changes to patient care and appointment scheduling

The third pathway involves joining an existing concierge medicine network. This option requires zero investment expenses, as the network will handle marketing, patient onboarding, and other operational tasks for you.

However, there are trade-offs to consider. While joining a network reduces the risk of starting your own business, you'll still be operating under the interests of another company.

This means you won't have complete autonomy over your practice, and the network will take a commission from your compensation to cover their labor and operating expenses.

Ultimately, choosing the pathway where your concierge medicine financial planning will be based depends on your individual circumstances, risk tolerance, and professional goals.

By carefully considering these factors, you can make an informed decision about which concierge medicine business model is right for you.

Before creating a business plan for concierge medicine, it's essential to define your professional and financial goals. What do you want to achieve with your concierge medicine practice? Do you want to:

Take the time to write down your goals and prioritize them. This will help you stay focused and ensure that your financial plan aligns with your objectives.

A business plan is a roadmap for your concierge medicine practice, outlining your goals, target market, financial projections, and marketing strategies. A well-crafted business plan will help you:

Don't be afraid to seek the help of a financial advisor or business consultant to ensure your business plan is comprehensive and realistic.

Starting a concierge medicine practice requires significant upfront costs, and you must make sure that no stone is left unturned. We have included ballpark figures to consider to make financial planning for concierge medicine more accurate on your end.

As of 2024, estimated start-up costs of setting up your private concierge medicine practice is around $50,000 - $200,000. Make sure to factor these costs when carrying out your membership-based medical practice financial planning.

In this journey, declaring accurate budgets is key. Underestimating startup costs can lead to financial strain and impact the long-term viability of your practice.

When it comes to building a financially sustainable concierge medical practice, your pricing strategy will play a critical role in determining your concierge medicine practice’s revenue and profitability.

When establishing your membership/subscription prices, it is important to consider the following factors:

Offering tiered pricing options can help you attract a wider range of patients and increase concierge medicine revenue streams. Consider offering different levels of service, such as:

When setting your prices, don't forget to factor in overhead costs which can be broken down into five major categories:

Staffing and personnel:

Marketing and advertising:

Office and overhead expenses:

Insurance and liability coverage:

Technology and software:

A typical concierge medicine practice in the U.S. covers an estimated $150,000 - $313,000 worth of expenses per year to stay up and running.

Failing to account for these costs will make managing cash flow in a concierge medical practice much more difficult.

Your marketing strategy will play a critical role in building a financially sustainable concierge medical practice. First, you must understand and get to know the patient market you wish to serve, or are already serving.

Typically, patients in concierge medicine have higher income and are willing to pay a little extra for personalized, high-quality medical care.

On that note, here are some marketing strategies you may want to consider and how much it will cost to run these initiatives:

Website and Online Presence:

Social Media Marketing:

Print and Local Advertising:

Event Marketing:

Public Relations and Community Outreach:

Referral Marketing:

Social media is a powerful marketing tool, allowing you to connect with potential patients and promote your services.

Consider building your presence on platforms where your patients are most active, like Facebook, Twitter, and Instagram. Don’t forget to use targeted advertising to reach your ideal patient demographic.

Referral marketing is a powerful way to set up your concierge medicine financial planning for long-term success. This helps attract new patients and builds a loyal patient base.

Encourage your existing patients to refer friends and family by offering incentives, such as discounts or free consultations.

Your financial plan is not a static document. It’s not a one-off thing you prepare only at the beginning of concierge medicine financial planning and leave untouched as you go along.

This will serve as the blueprint of your concierge medicine practice and should be regularly reviewed and updated to reflect changes in your practice and the market.

To offset the expenses in your financial plan, you will need to project how much revenue you must generate to cover these costs. Regularly review your financial statements to ensure you're on track to meet your financial goals.

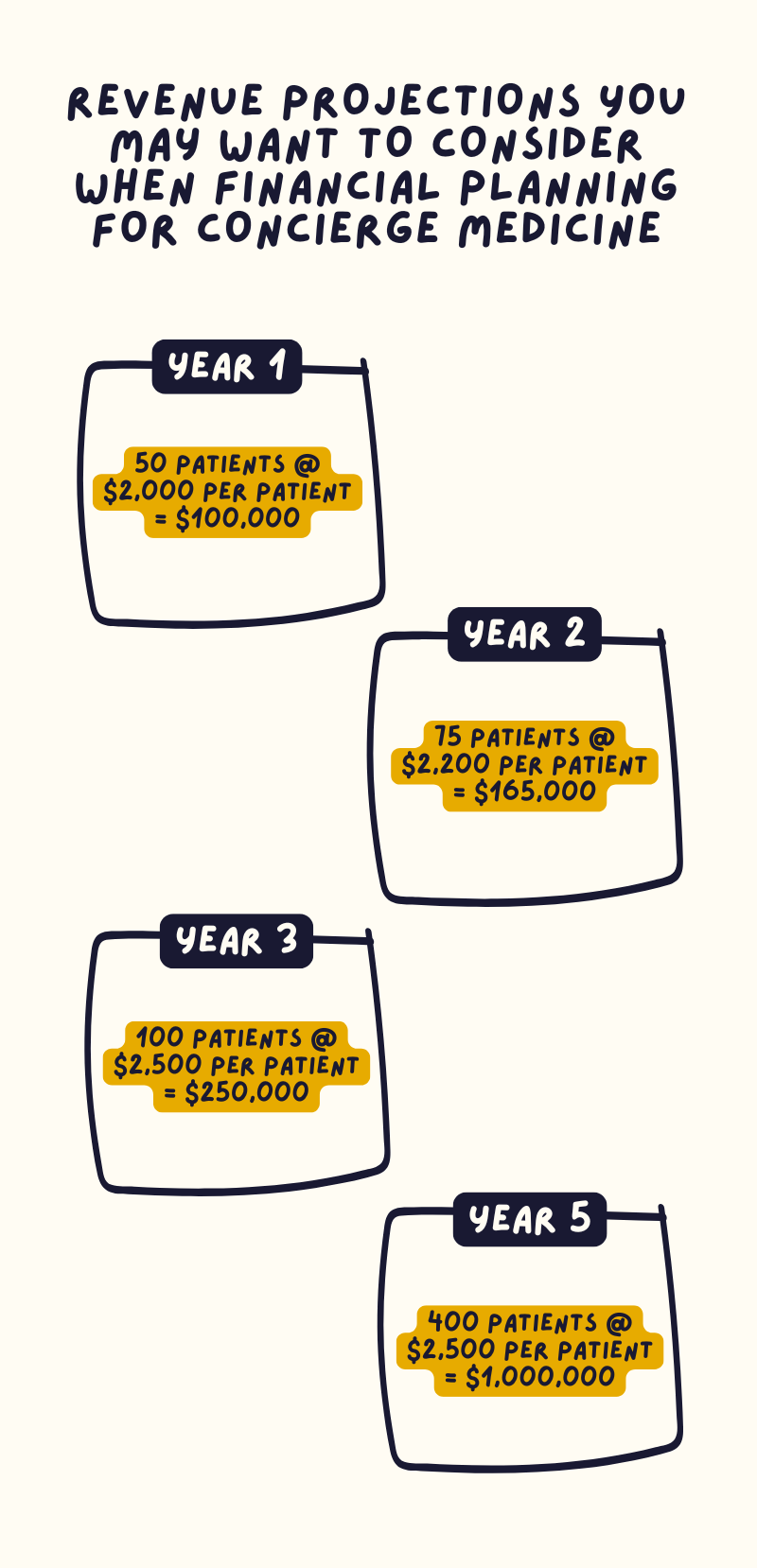

The average annual fee for concierge medicine practices ranges from $1,500 to $3,000 per patient.

Assuming your practice runs at a moderate growth rate, here are some revenue projections you may want to consider when financial planning for concierge medicine:

Year 1: 50 patients @ $2,000 per patient = $100,000

Year 2: 75 patients @ $2,200 per patient = $165,000

Year 3: 100 patients @ $2,500 per patient = $250,000

Year 5: 400 patients @ $2,500 per patient = $1,000,000

Don't be afraid to make adjustments to your financial plan if you're not meeting your financial goals. These adjustments could involve:

By following these do's and don'ts, you are well on your way to high-end medical practice financial management.

Creating a comprehensive financial plan helps you achieve your concierge medicine goals and build a successful concierge medicine practice in the long run.

Remember to stay flexible and adapt to changes in the market and your practice, and don't hesitate to seek the help of a financial advisor or business consultant if you need guidance.

You can also check out our other blogs at FindMyDirectDoctor.com for further knowledge on financial planning for concierge medicine.

Previous Post